Park Bonds

A new mechanism to secure the long-term financing of Protected Area networks

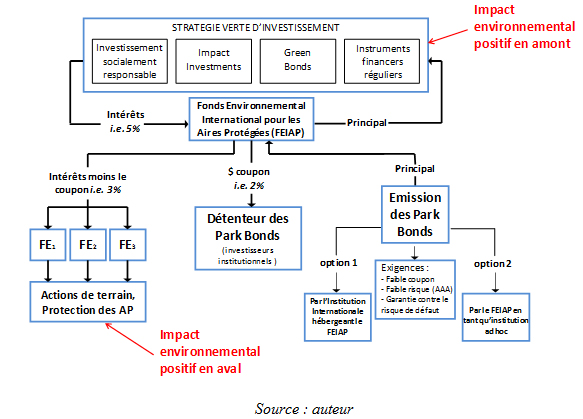

Creating responsible financial products in favor of biodiversity protection is an achievable goal. Provided a convincing scheme is set up, institutional investors could well be interested in investing in new financial products dedicated to biodiversity. This article presents the advantages and drawbacks of two existing environmental assets – Forest Bonds and Green Bonds – in order to argue the case for a new type of environmental asset targeting the conservation of Protected Areas: Park Bonds.

Park Bonds are a new type of green financial instrument intended to fund conservation by offering a Triple-A credit rating to investors and a low (below 2 per cent) coupon rate. Park Bonds are defined as a fixed income product that offers investors the opportunity to participate in the financing of conservation projects through the capitalization of an International Trust Fund, interest from which will be distributed to bond holders and identified beneficiaries.

Park Bonds could be issued by an International Trust Fund for Protected Areas (ITFPA), either hosted by a Multilateral Development Agency such as the World Bank or the Global Environment Facility, or set up as an ad hoc institution. Conservation projects would not have to generate income to repay the Park Bonds, as currently proposed with Forest Bonds or Green Bonds, but rather the ITFPA, tasked with promoting ethical financing. The remaining interest (after coupon payment) would be distributed to the international network of Conservation Trust Funds (CTFs) for Protected Areas financing. Park Bonds would allow the creation of a new and ambitious funding stream for conservation projects, while offering investors high credit worthiness and fixed-income investment opportunities with major positive environmental impacts and substantial potential for expansion.

General functioning of Park Bonds

According to the diagram above, for every USD 1 billion of Park Bonds issued, USD 30 million would be provided annually to the network of CTFs.

Park Bonds are at an early stage of development and face several challenges, not least obtaining commitments from one or more advanced economies or international organizations that they will provide a Park Bond guarantee. Park bonds are an ambitious concept that will only materialize if the idea wins the backing of important stakeholders (e.g. World Bank, CBD, key governments). If given a chance, it has the potential to substantially transform the conservation finance framework site.

The full article is available here.